omaha nebraska vehicle sales tax

Questions regarding Vehicle Registration may be addressed by email or by phone at 402 471-3918. In addition to taxes car purchases in Nebraska may be subject to other fees like registration title and plate fees.

Used Chevrolet Colorado For Sale In Omaha Ne Edmunds

This means that depending on your location within Nebraska the total tax you pay can be significantly higher than the 55 state sales tax.

. County or City 2021 Net Taxable Sales 2020 Net Taxable Sales Percent Change 2021 Sales Tax 55 2020 Sales Tax 55 Adams 6448935 6923320 69 35572240 38290378 Antelope Comparison of October 2021 and October 2020 Motor Vehicle Sales Tax Collections by County Nebraska Department of Revenue. The Nebraska state sales and use tax rate is 55 055. There are no changes to local sales and use tax rates that are effective July 1 2022.

This is the total of state county and city sales tax rates. The sales tax is still due from the customer even if the deal certificate covers the full price of the article redeemed. Notification to Permitholders of Changes in Local Sales and Use Tax Rates Effective July 1 2022.

The exception to this is a vehicle that is currently titled in the name of the purchasers parentguardian or. Nebraska City 20 75 075 16-339 33705 Nehawka 10 65 065 240-340 33740 Neligh 10 65 065 91-341 33775 Nelson 10 65 065 80-342 33880 Newman Grove 15 70 07 98-346 34230 Niobrara 10 65 065 73-349 34370 Norfolk 15 70 07 15-351 34615 North Bend 15 70 07 92-353 34720. Current Local Sales and Use Tax Rates and Other Sales and Use Tax Information.

Repair labor on motor vehicles. The Omaha sales tax rate is. Nebraska collects a 55 state sales tax rate on the purchase of all vehicles.

- 2000 Total Due. Motor Vehicle Tax Calculation Table MSRP Table for passenger cars vans motorcycles utility vehicles and light duty trucks wGVWR of 7 tons or less. To register an apportioned vehicle vehicles over 26000 pounds that cross state lines contact the Department of Motor Vehicles Motor Carrier Services.

If you are registering a motorboat contact the Nebraska Game and Parks Commission. County or City 2021 Net Taxable Sales 2020 Net Taxable Sales Percent Change 2021 Sales Tax 55 2020 Sales Tax 55 Adams 9207855 2443546 2768 50814645 13480065 Antelope Comparison of May 2021 and May 2020 Motor Vehicle Sales Tax Collections by County Nebraska Department of Revenue. 100K for married couples filing.

Please note that the total amount due from the customer consists only of the tax calculated and collected by the clothing store on this transaction. 1500 - Registration fee for passenger and leased vehicles. 2021 Sales Tax 55.

The Registration Fees are assessed. Registration fee for commercial truck and truck tractors is based upon the gross vehicle weight of the vehicle. You can find these fees further down on the page.

State Sales Tax 184718 Motor Vehicle Tax 700 Local Sales Tax 50378 Omaha Wheel Tax 50 Motor Vehicle Fee 30 Passenger. The statistics are grouped by county. 2020 Sales Tax 55.

Greater Omaha Chamber of Commerce UNO. Which in turn is used to complete the Nebraska SalesUse Tax and Tire Fee Statement for Motor Vehicle and Trailer Sales Form 6 as a trade-in must be titled in the name of the purchaser. Form Title Form Document Nebraska Tax Application with Information Guide 022018 20 Form 55 Sales and Use Tax Rate Cards Form 6 Sales and Use Tax Rate Cards Form 65 Sales and Use Tax Rate Cards Form 7 Sales and Use Tax Rate Cards Form 725 Sales and Use Tax Rate Cards Form 75 Sales and Use Tax Rate Cards Form Nebraska Application for Direct.

2021 Sales Tax 55. The County sales tax rate is. The minimum combined 2022 sales tax rate for Omaha Nebraska is.

2020 Net Taxable Sales. The Nebraska sales tax rate is currently. 2020 Sales Tax 55.

Repair labor involved in restoring the original form and condition of a motor vehicle or replacing a component part in a motor vehicle trailer or semitrailer. Repair labor performed on any item the sale of which is not subject to sales tax. 2020 Net Taxable Sales.

Registration fee for farm plated truck and truck tractors is based upon the gross vehicle.

10 Sponsorship Form Templates Word Excel Pdf Templates Sponsorship Form Template Sponsorship Donation Form

Superlative 1927 Sinclair Aviation Gasoline Restored American Visible Gas Pump Model 2487 Barrett Jackson Auction Vintage Gas Pumps Gas Pumps Petrol Station

R M Auto Sales Cars For Sale Auto The Body Shop

Sales Tax On Cars And Vehicles In Nebraska

Motor Vehicles Douglas County Treasurer

Military Relocation Pcsing To Omaha Military Relocation Omaha Relocation

Pros And Cons Of An Open House In Omaha Nebraska Sell My House Fast Sell My House Open House

What S Included In Your Square Footage Selling Real Estate Real Estate Realtor License

Find Great Service Specials In Omaha Ne

Map Of Peony Park Vintage Beach Posters Omaha Nebraska Vintage Beach

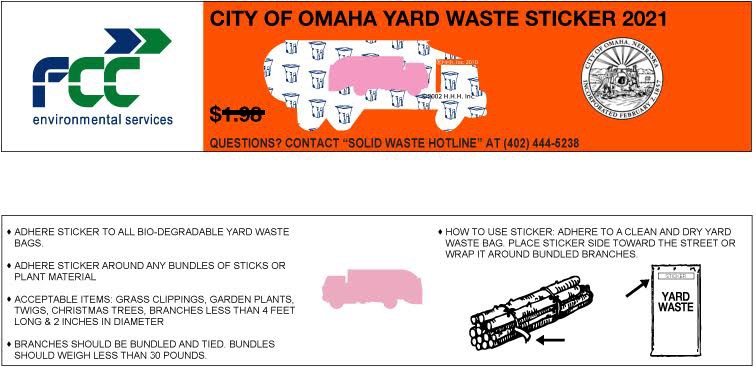

Yardwaste Sticker Locations And Instructions Wasteline Omaha

Gulf Golf Gulf Racing Vw Rabbit Volkswagen

Auto Service Inspection Parts Installation Specials In Omaha Ne

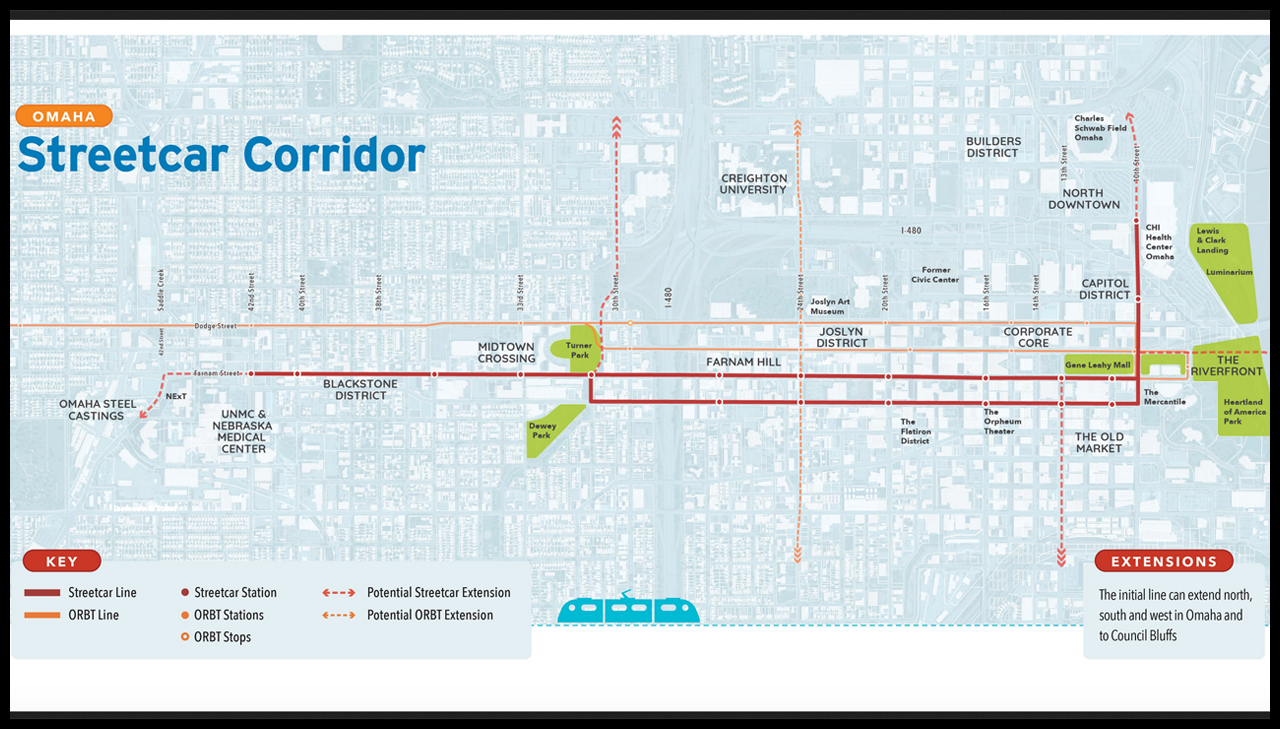

Downtown Omaha Plan Adds Streetcar Puts Mutual Of Omaha Into Current Library Space

Fenway Park Motors In The Late 1950 S Cool Old Cars Boston Pictures Old Pictures

A Streetcar For Omaha Railway Age

Downtown Omaha Plan Adds Streetcar Puts Mutual Of Omaha Into Current Library Space

Jarts My Friends And I Used To Love Playing With These Then Kids Started To Get The Heavy Metal Points St Outdoor Games Adults Childhood Memories Childhood